Still waiting on your ERTC refund check?

But after months of research & negotiation, we finally found a firm who provides ERTC advances in 2-4 weeks.

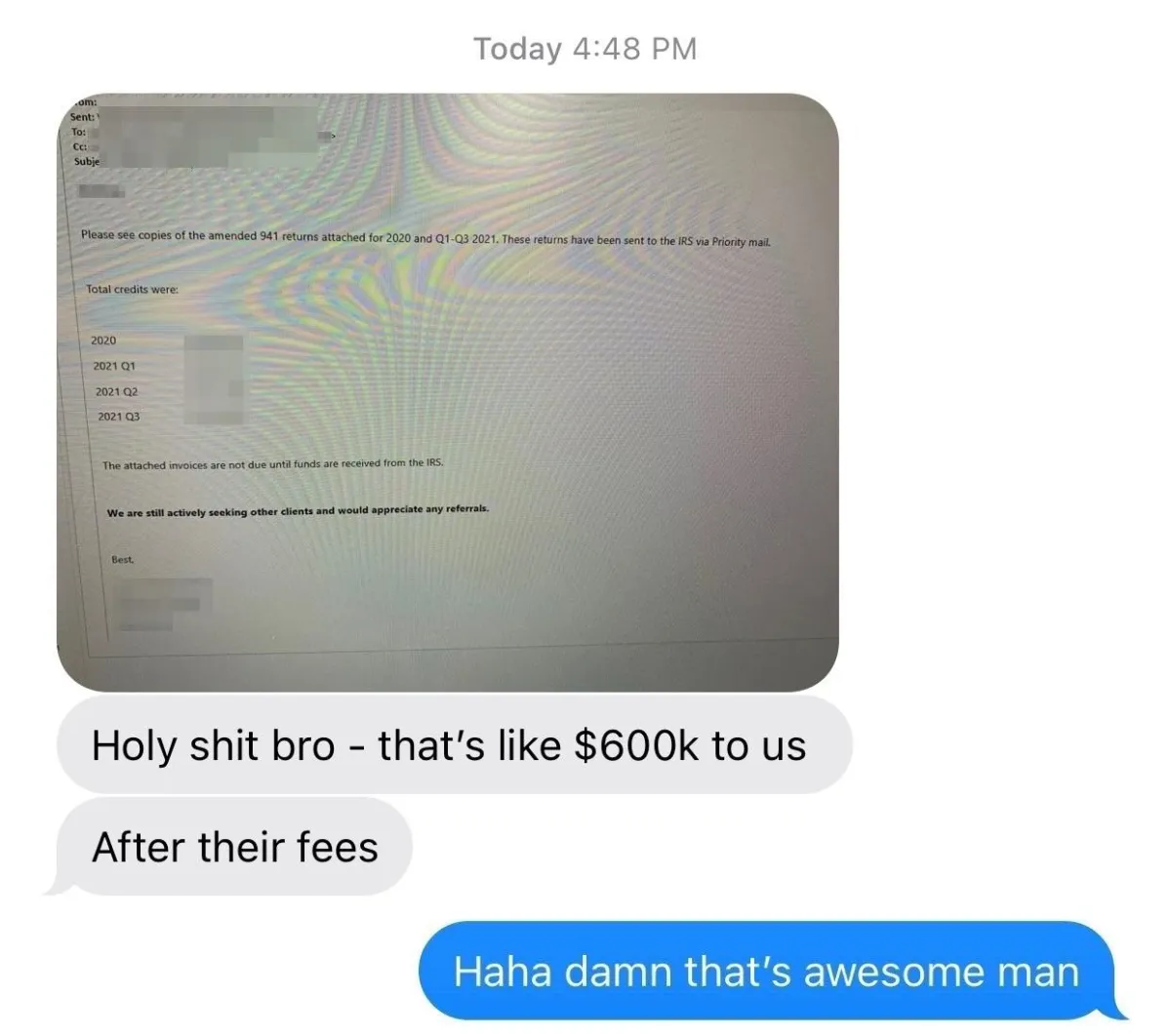

👋 Recent Case Studies & Refund Checks👇

Bar & Nightlife Industry - $553,500+ in 2020 & 2021 - 41 employees

Healthcare Industry - $599,891.59 for 2020 – 195 employees

Contracting Industry - $364,283.71 for Q1 2021 - 59 employees

Nonprofit Industry - $111,150.41 for 2020 - 25 employees

Restaurant Industry - $213,029.88 for 2020 – 56 employees

Distribution Industry - $1,152,330.98 for Q1 2021 – 208 employees

Home Services Industry - $39,262.33 for 2020 – 23 employees

Manufacturing Industry - $252,104.88 for 2020 – 63 employees

Hospitality/Hotel Industry - $620,416.97 for 2020 - 383 employees

Marketing Industry - $50,954.46 for Q3 2021 - 11 employees

Food Prep Industry - $528,340.02 for Q1/Q2 2021 - 156 employees

School/Education Industry - $111,150.41 for 2020 - 25 employees

Gym & Exercise Industry - $51,455.01 for 2020 - 16 employees

Church/Religious Organization - $30,782.22 for 2020 - 12 employees

Franchise Industry - $371,551.39 for 2020 - 312 employees

Beaty/Hair Salon Industry - $107,793.22 for 2020 - 36 employees

Staffing/Recruiting Industry - $275,099.46 for 2020 - 326 employees

Field Exam Industry - $324,846.66 for Q1/Q2 2021 - 30 employees

Engineering Industry - $21,000+ for Q1-Q3 2021 - 2 employees

Restaurant Industry - $1,950,000+ for 2020 & 2021 - 150 employees

Franchise Industry - $5,250,000+ for 2020 & 2021 - 350 employees

Software Industry - $398,017.23 for 2020 - 19 employees

Insurance Industry - $127.932.01 for 2020 - 9 employees

Security Industry - $1,245,000+ for 2020 & 2021 - 389 employees

Nonprofit Industry - $245,000+ for 2020 - 49 employees

Campground/RV Industry - $260,973.10 for 2020 - 73 employees

Cleaning Industry - $170,865.03 for 2020 - 55 employees

Pizza & Sandwich Industry - $376,455.17 for 2021 - 91 employees

Multi Location Restaurant - $203,233.79 for 2020 - 53 employees

Want To Learn More?

WHAT'S THIS NEW TAX CREDIT FOR?

The Employee Retention Credit (ERC/ERTC) was authorized under the CARES Act and encouraged organizations to keep employees on their payroll during the C19 pandemic (both for-profit companies & non-profit organizations are eligible).

- The 2020 ERC Program is a tax credit for 50% of up to $10,000 in wages paid PER EMPLOYEE from 3/12/20-12/31/20 by an eligible employer.

- THAT’S UP TO $5,000 PER EMPLOYEE in 2020!

- The 2021 ERC Program increased to 70% of up to $10,000 in wages paid PER EMPLOYEE PER QUARTER.

- THAT’S UP TO $28,000 PER EMPLOYEE in 2021!*

- *(Q1-Q3 for companies operating prior to 2/15/20)

✅ FAQs & Common Misconceptions ⛔

"How do I use a tax credit? How do I benefit from this? What does it cost?"

Although it is technically called a "tax credit," it is most frequently received as a cash payment from the IRS. There is also no dollar limit for how much a business can receive, and no requirements for how you spend it once you've been approved.

This program is not an "income tax credit" and isn't related to your annual business tax returns or your income statement/P&Ls. Because the credit is based on W2 payroll taxes, nonprofits are eligible as well.

While these tax credits in theory should be retroactive for a while, there's no guarantee how long the funding for this will last or if the incentives will be changed once again in the future.

The good news is that it won't cost you anything to find out. We found and vetted ERC accounting specialists who have kept up with all the recent legislative changes, will explain your local/state requirements, and help you determine your eligibility (at no cost) and calculate the correct refund amount your business may be owed.

"What is an Eligible Employer? And what is the qualifying criteria to be approved?

Eligible Employers for the purposes of the Employee Retention Credit are those that carry on a trade or business during calendar years 2020 & 2021 (including a tax-exempt organization) that either:

1. Fully or partially* suspended operations by a governmental order

(AND/OR)

2. Experienced a significant decline in gross receipts during a calendar quarter

*It is absolutely critical to get specialized advice about this. (And possibly even a 2nd opinion). An organization can be considered "partially suspended" if a state/local mandate imposed restrictions by limiting commerce, travel, or meetings (for social, commercial, religious, or other purposes). This can be a "Stay at Home" order, limited indoor/on-site access, limited/canceled in-person meetings and other capacity restrictions, reduced operating hours, delayed production timelines due to supply chain issues, or several other possibilities you should consider and seek personal advice on.

"Wasn't the credit only available in 2020? Wasn't it an alternative to the PPP?"

The ERC was not widely used until March 2021, when updated IRS regulations made this type of COVID-19 Relief more accessible. In short: thousands of businesses who once had to "choose" between the Paycheck Protection Program (PPP) and ERC can now qualify for both by amending their Quarterly 941s.

It's critically important to realize the legislation for this program has changed FIVE times in the past year, and still has many pending changes that are currently being voted on (at the time of writing).

Want more information? Just read Notice 2021-20 on the official IRS FAQ website. Refunds are currently being processed daily by tax credit professionals. That said, the IRS backlog is starting to increase as well, so time is of the essence to find out if your business qualifies for this refund ASAP.

"Doesn't my payroll provider or my CPA have this information?"

As with most things in business, tax credits often require specialized knowledge and experience. Considering the legislation on ERC has already changed several times, it's understandable that many payroll firms, CPAs, and tax advisors may not want to risk their license (or don't have time) to advise on and calculate an audit-ready refund check for a once-in-a-pandemic incentive program like the ERC.

It's important to fully document all processes and procedures, organize records properly, and ideally avoid an IRS audit. The ERC has complex calculating requirements such as Controlled Group criteria, documenting qualification methodology, coordination with PPP loans, allocating healthcare expenses to the appropriate time periods, etc. Hiring specialists can help reduce "audit stress" while also not worrying about leaving a ton of money on the table.

Recent Success Stories 😎

LESLIE E.

Medical Practice Owner

"When the Employee Retention Credit was included in the CARES Act, we knew we wanted help navigating the guidelines, calculations, and paperwork so we could maximize our tax credit and get everything filed correctly. We were very pleased with their team and their services."

IAN D.

Creative & Development Agency

"They are the experts when it comes to helping get the ERC. They do an excellent job walking you through the steps of what is needed for them to move forward, and make sure you’re approved before any additional steps are taken. They’re knowledgeable and take care of everything for you."

Carlton H.

Home Services Company

"Their firm was very good at knowing the laws and rules of the refund that we received. I didn't know anything about these before talking to a friend who referred me. To date we have received about $80,000 with more coming. I would advise anyone to just reach out to see if it works for you also.

Mike H.

Restaurant Owner

"Unlike the PPP Loan, these credits can be spent on any cash needs and are income. I have, with their help, received funds. Great program, increased income to secure your business in this weird time. Clarity provided is so important. Thanks to their team for all their hard work."

DAVID H.

Educational Services Company

"The team was very diligent and detail-oriented walking us through the process of applying for and receiving ERC even though our business had previously received a forgiven PPP Loan. Their team was able to quickly prepare accurate documents and we received a check for every quarter we filed."

Michael M.

Food Services Company

"Working with them was easy and everything worked out as they said it would. Just took the IRS some time to get it done. This is real and it is to your benefit for the covid restrictions from the government. All you need to do is mail the documents that they calculate and prepare for you."

Only 4 Simple Steps To Claim Your Refund Check

1. Data Gathering

In a few minutes, securely upload your 941 returns, PPP loan documents, and payroll data.

2. Credit Calculation

ERC specialists will calculate the exact value of the credit you can receive from the IRS.

3. Amend Returns

Automatically prepare and file the 941-X Amended payroll returns on your behalf.

4. Get Paid

The IRS will process the credit and mail out your refund check once approved.

About the CEO: Nick Apollo

Average CEO | Mediocre Author | Unsophisticated Investor | Industry Thought Needer | Awkward Public Speaker & Podcaster

Over the past few decades, I discovered the only thing I'm actually kinda good at is finding and hiring people who are far more talented than me...

Eventually, we assembled a holistic team & 'virtual family office' of 173 embarrassingly expensive (but ROI effective) B2B services & solutions.

To keep it simple, we really only do two things:

→ Make you more money (with guaranteed ROI)

→ Save you more money (with zero risk to try)

So for the sake of transparency, here’s our entire business model...

Questions? Book A Free Coaching Call ⤵︎

Or Just Fill Out This Simple Quiz To See If You're Eligible For A Cash Refund Check Too

Allies International

Personal endorsement from Kevin Harrington (from SharkTank):

Yanik Silver

Advisor & Author of Evolved Enterprise

Yanik is well-known speaker, marketer, copywriter, leader of the mastermind group Maverick 1000, and author of "Evolved Enterprise" that combines business & impact.

Trevor Blake

Advisor & 9 Figure Entrepreneur

Trevor has built and sold 3 companies for a combined EV of over $600M+, and currently runs multiple businesses from home with only a 5 hour workday.

Want To Learn More?

YouTube and the YouTube logo are registered trademarks of Google Inc. This site is not affiliated with YouTube or Google Inc. in any way. This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc. DISCLAIMER: All Information Shared Are The Sole Thoughts and Opinions Of The Author. Do Not Take Any Information As Legal Or Financial Advice. You Should Always Seek A Certified Accountant And A Professional Legal Team Before Taking Any Further Action. We are not selling or soliciting a security in any way, shape, or form. This content is for educational purposes only and is not personalized financial, tax, investment or legal advice. The goal of everything we do is to inform you about new ideas, strategies, and opportunities, and then introduce corresponding experts and specialists in our network who can help you implement them. As with pretty much everything in business and life - your personal situation is unique and depends on a lot of factors that we cannot advise on. But we can introduce you to people we've personally vetted who will do their best to help.

© Copyright 2023+ Allies International | Legal | Contact | [email protected] | (844) 219-2559